Volt - Paiements de compte à compte en temps réel

L'avenir des paiements bancaires instantanés pour votre entreprise

Volt est une solution de paiement de compte à compte (A2A) en temps réel de nouvelle génération qui permet aux entreprises d'accepter des paiements instantanés, sécurisés et économiques directement depuis les comptes bancaires de leurs clients. Basé sur la technologie de l'open banking, Volt élimine le recours aux cartes, réduisant ainsi les coûts, les risques de fraude et les rejets de débit.

Avec une couverture dans plus de 1 800 banques en Europe, au Royaume-Uni et au-delà, Volt offre des expériences de paiement transparentes pour le commerce électronique, les marchés et les services financiers.

Pourquoi choisir Volt ?

- Règlement instantané

Recevez des fonds en temps réel grâce à des virements bancaires instantanés, améliorant ainsi les flux de trésorerie et réduisant les délais de paiement. - Sécurité de niveau bancaire

Les transactions sont authentifiées directement par la banque du client, garantissant une sécurité élevée sans avoir besoin de détails de carte ou de mots de passe. - Coûts réduits

En contournant les réseaux de cartes, Volt réduit considérablement les frais de traitement et élimine les rétrofacturations. - Portée mondiale

Développez-vous sur de nouveaux marchés avec un accès au plus grand réseau de paiement bancaire au Royaume-Uni, dans l'UE, au Brésil et au-delà. - Taux de conversion plus élevés

Les paiements rapides et fluides améliorent l'expérience client et réduisent les abandons de paiement.

Comment fonctionne Volt

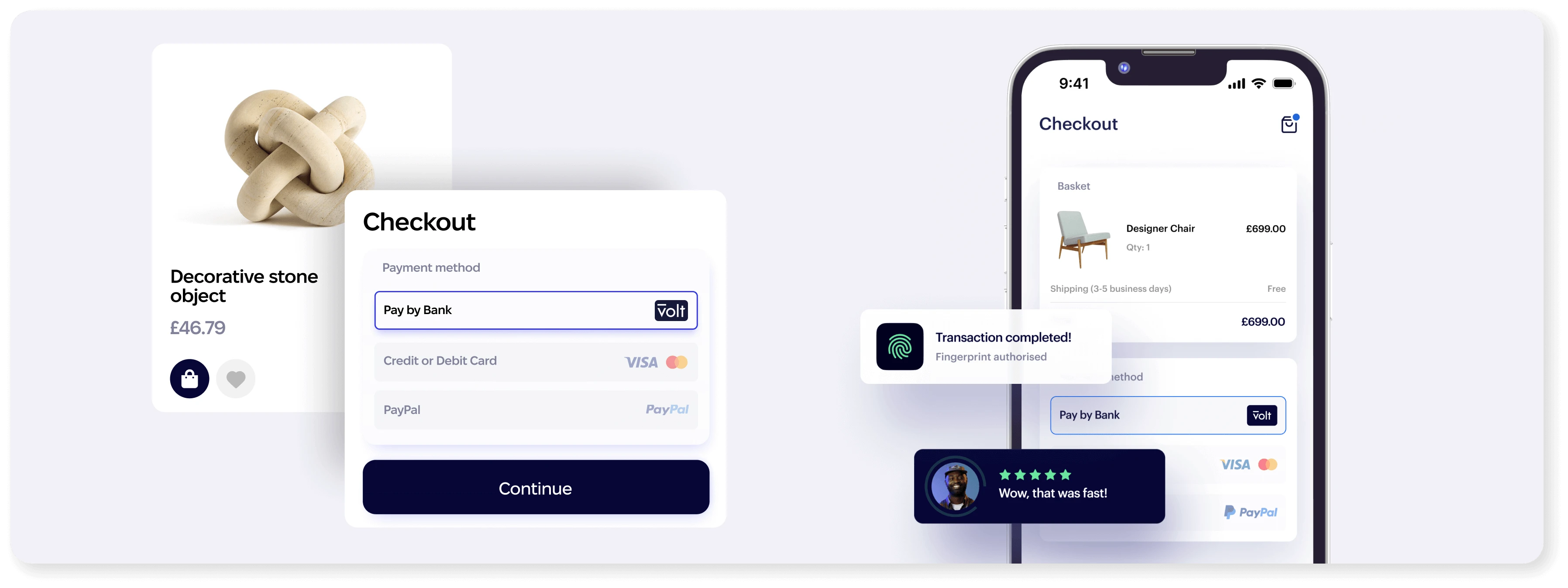

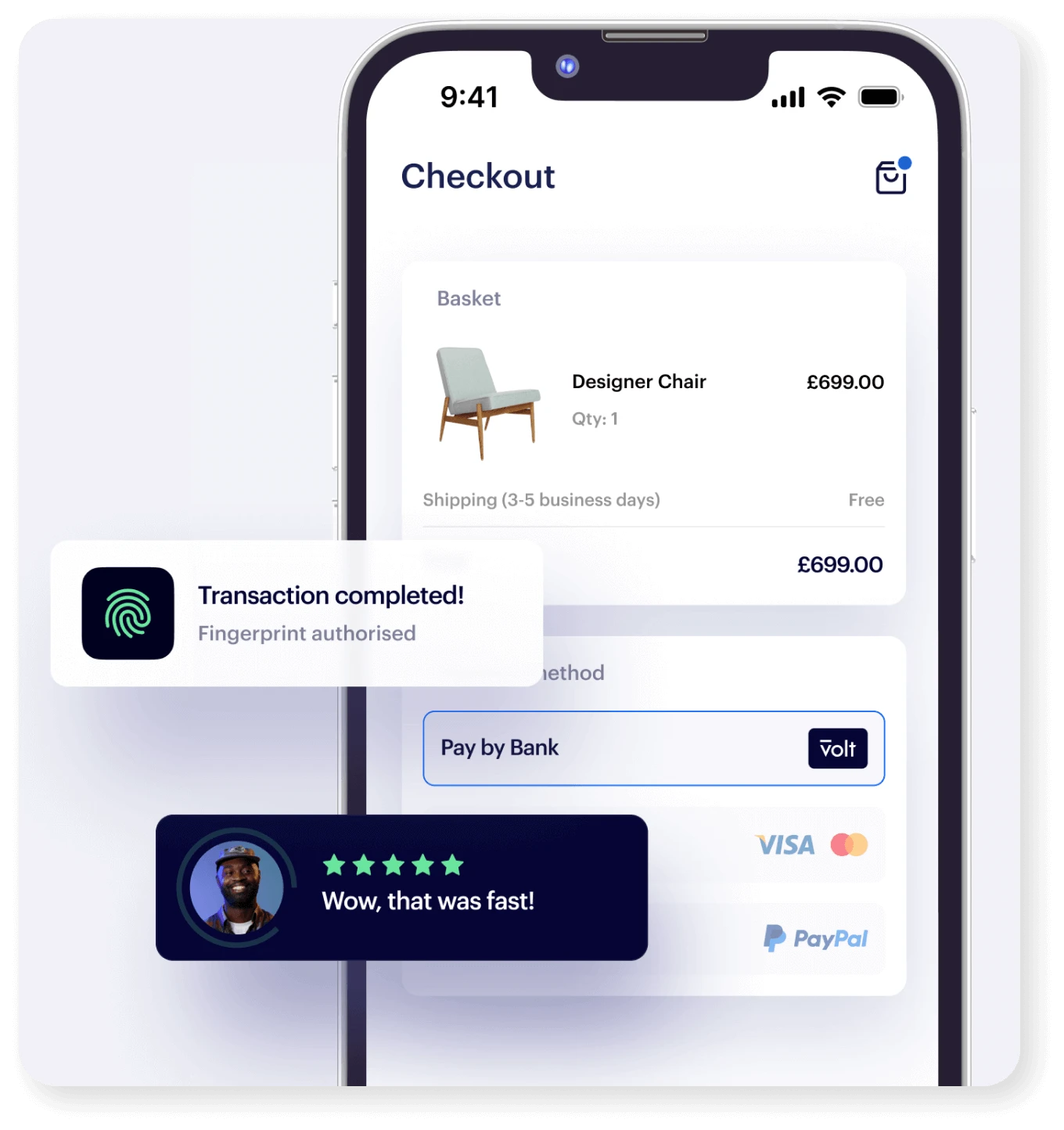

- Le client sélectionne Volt au moment du paiement,

Disponible sur les sites Web, les applications mobiles. - Le client choisit sa banque

Volt les connecte instantanément à leur application bancaire. - Le client approuve le paiement

Authentification via biométrie ou identifiants bancaires. - Les fonds sont transférés instantanément

Les entreprises reçoivent une confirmation et un règlement en temps réel.

Pas de cartes, pas de saisie manuelle de données, pas de frais cachés – juste des paiements bancaires transparents.

Cas d'utilisation des paiements Volt

- Commerce électronique et vente au détail en ligne: Améliorez la conversion des paiements grâce à des paiements rapides et directs auprès des banques.

- Marchés et plateformes: Permettre des transferts de fonds transparents entre acheteurs et vendeurs avec des règlements en temps réel

- Jeux en ligne et paris: Répondez aux exigences réglementaires avec des dépôts et des paiements instantanés.

- Voyages et billetterie: Réduisez le risque de fraude et améliorez l'expérience de réservation grâce aux paiements directs sur compte.

- Abonnements et paiements récurrents: Proposez des paiements bancaires directs pour les entreprises basées sur un abonnement.

Pourquoi intégrer Volt avec MyauPay ?

- Intégration sans effort

Ajoutez Volt à votre caisse avec une API unique aux côtés des cartes, des portefeuilles et d'autres méthodes de paiement locales. - Paiements plus rapides

Utilisez Volt pour des retraits et des remboursements instantanés, améliorant ainsi la satisfaction client. - Analyse complète

Suivez les données de paiement en temps réel et obtenez des informations avec le tableau de bord de MyauPay. - Sécurisé et conforme

Construit sur une infrastructure bancaire ouverte avec une sécurité conforme à la PSD2. - Prise en charge multidevises

Acceptez les paiements bancaires dans plusieurs régions avec prise en charge de la devise locale.

Volt vs. Méthodes de paiement traditionnelles

L'avenir des paiements commence avec Volt et MyauPay

Alors que les paiements bancaires en temps réel connaissent une croissance rapide, Volt change la donne pour les entreprises qui cherchent à optimiser les coûts de paiement, à réduire la fraude et à améliorer l'expérience client.

Commencez à accepter les paiements Volt dès aujourd'hui

Intégrez de manière transparente Volt à MyauPay et offrez des paiements rapides, sécurisés et à faible coût à vos clients.

Cet article est fourni à titre informatif et éducatif uniquement et ne doit pas être interprété comme un conseil juridique ou fiscal. MyauPay ne garantit pas l'exactitude, l'exhaustivité, la pertinence ou l'actualité des informations fournies. Pour des conseils adaptés à votre situation particulière, consultez un avocat ou un comptable qualifié et autorisé à exercer dans votre juridiction.