Are you worried about how to keep your business safe from data breaches?

The growing number of cyberattacks is putting businesses at risk, and the consequences can be devastating.

Not only can breaches lead to lost customer trust, but they can also result in hefty fines. That’s where PCI DSS comes in. This security standard helps businesses safeguard sensitive payment data, protecting both your company and your customers.

In this post, we’ll explain why PCI DSS compliance is essential for any business handling payment information.

What is PCI DSS?

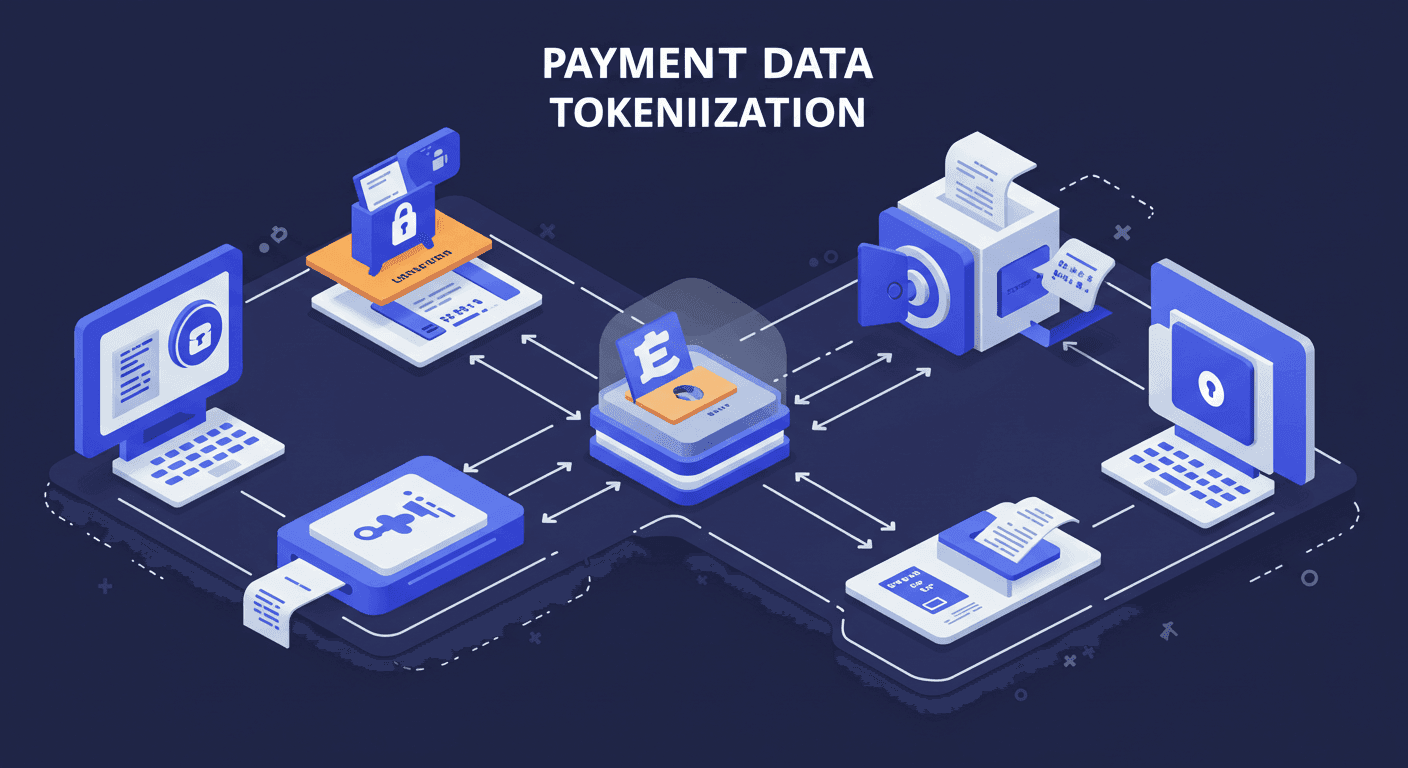

PCI DSS, or Payment Card Industry Data Security Standard, is a set of security measures created to protect cardholder data during transactions. It was developed by major credit card companies like Visa, MasterCard, and American Express, with the goal of reducing fraud and protecting consumers.

PCI DSS includes a wide range of standards that businesses must follow when storing, processing, or transmitting cardholder information.

The guidelines cover everything from encryption requirements to network security measures, ensuring that businesses handle payment data securely. Compliance with PCI DSS helps establish trust with customers and improves the overall security of the payment system.

Why PCI DSS Compliance is Critical

While the main goal of PCI DSS is to protect customer data, the implications of non-compliance go far beyond simple data protection. Here’s why compliance is crucial:

Security Risks:

Without PCI DSS, your business becomes vulnerable to cyberattacks, data breaches, and financial fraud. Hackers target companies with weak security practices to steal sensitive payment information, which can lead to massive financial losses.

Legal and Financial Consequences:

A data breach can result in expensive penalties from regulatory bodies, as well as the loss of the ability to process card payments. In fact, businesses that fail to comply with PCI DSS may face fines, which can range from thousands to millions of dollars. Not only that, but the legal costs and reputational damage from a breach can be far more costly in the long run.

Customer Trust:

If customers don’t feel confident that their payment information is secure, they may choose to take their business elsewhere. This loss of trust can severely impact your company’s reputation and customer loyalty.

In short, non-compliance with PCI DSS could lead to severe financial, legal, and reputational damage to your business. Ensuring your business is PCI DSS compliant is an investment in security and customer trust.

How PCI DSS Protects Your Business and Customers

PCI DSS isn’t just a set of rules to follow—it’s a system that benefits both your business and your customers. Here’s how:

Preventing Fraud:

PCI DSS guidelines require businesses to use encryption and other data protection measures to secure cardholder information. These safeguards help prevent fraudsters from accessing sensitive payment data, reducing the risk of financial loss.

Enhancing Security Measures:

PCI DSS helps businesses create a secure network for storing and processing payment data. This means implementing firewalls, password protection, and regular system monitoring to detect potential threats before they turn into attacks.

Building Customer Trust:

Customers are more likely to make purchases from businesses that demonstrate a commitment to protecting their personal information. By displaying your PCI DSS compliance, you show that your business takes their privacy seriously, fostering loyalty and confidence.

Avoiding Data Breaches:

Compliance with PCI DSS ensures that your business has a proactive strategy to prevent data breaches. The standard provides a clear framework for securing sensitive information, which helps reduce the likelihood of a breach occurring in the first place.

In today’s competitive business landscape, ensuring that your customers’ payment data is secure is essential. By adhering to PCI DSS standards, you demonstrate your commitment to data security and build trust with your customer base.

How to Become PCI DSS Compliant

Achieving PCI DSS compliance might seem like a daunting task, but it can be broken down into manageable steps. Here’s how your business can get started:

Assess Your Current Security Practices:

The first step is to assess your current practices for handling cardholder data. Identify any areas that need improvement to meet PCI DSS requirements.

Install Necessary Security Systems:

Implement the required security systems, such as firewalls, data encryption, and access control measures. This will help ensure that all payment data is stored and transmitted securely.

Perform Regular Audits and Assessments:

Regularly test your security systems to make sure they’re functioning correctly and in line with PCI DSS standards. Conduct audits to identify vulnerabilities and address them before they can be exploited.

Train Your Employees:

Ensure that your staff understands the importance of PCI DSS and how to handle cardholder data securely. Regular training helps minimize human error, which is a common cause of data breaches.

Seek Professional Help If Needed:

Many businesses find it helpful to consult with a PCI DSS compliance expert or third-party auditor. This can speed up the process and ensure you meet all the necessary requirements.

Common Challenges in PCI DSS Compliance

While the benefits of PCI DSS compliance are clear, there are some challenges that businesses may face during the process:

Complexity of Requirements:

PCI DSS includes numerous guidelines, which can be overwhelming for businesses that don’t have dedicated IT security teams. Understanding and implementing all the requirements can take time and effort.

Costs of Implementation:

Implementing PCI DSS-compliant security systems can be costly, especially for small businesses. However, the investment is worth it in the long run, as it helps protect your company from far greater financial losses due to security breaches.

Ongoing Maintenance:

Compliance is not a one-time task—it requires regular updates, audits, and employee training to maintain security standards. This can be time-consuming but is essential for staying compliant.

Despite these challenges, the benefits of PCI DSS compliance far outweigh the costs. With the right resources and planning, businesses of all sizes can successfully meet these standards.

Conclusion: The Benefits of PCI DSS for Your Business

PCI DSS is not just a set of guidelines—it’s a necessary framework for protecting your business and customers from security threats.

Compliance ensures that your payment systems are secure, prevents fraud, and helps maintain customer trust. Although achieving compliance can be challenging, the long-term benefits far outweigh the costs.

By following the steps to become PCI DSS compliant, you protect your business from potential breaches and penalties while showing customers that their data is in safe hands.

FAQs

Is PCI DSS compliance mandatory for all businesses?

PCI DSS compliance is mandatory for any business that stores, processes, or transmits credit card information. However, the specific requirements may vary depending on the size of the business and the volume of transactions.

How often do I need to renew my PCI DSS compliance?

PCI DSS compliance is an ongoing process. Businesses should conduct regular security assessments and audits to ensure continued compliance. Some businesses may need to revalidate their compliance annually, depending on their size and the level of risk associated with their payment processes.

What are the consequences of not being PCI DSS compliant?

Failure to comply with PCI DSS can result in heavy fines, penalties from credit card companies, and the potential loss of the ability to process credit card payments. Additionally, non-compliance increases the risk of data breaches, which can lead to financial and reputational damage.