How will the new laws in the US and EU impact payment processing?

The world of payment processing is undergoing significant changes, with both the US and EU introducing new regulations.

These laws could shape how businesses and consumers handle payments, making it crucial to understand their effects. In this blog, we will explore how these changes could impact the financial industry and what businesses and consumers need to know.

Payment Processing:

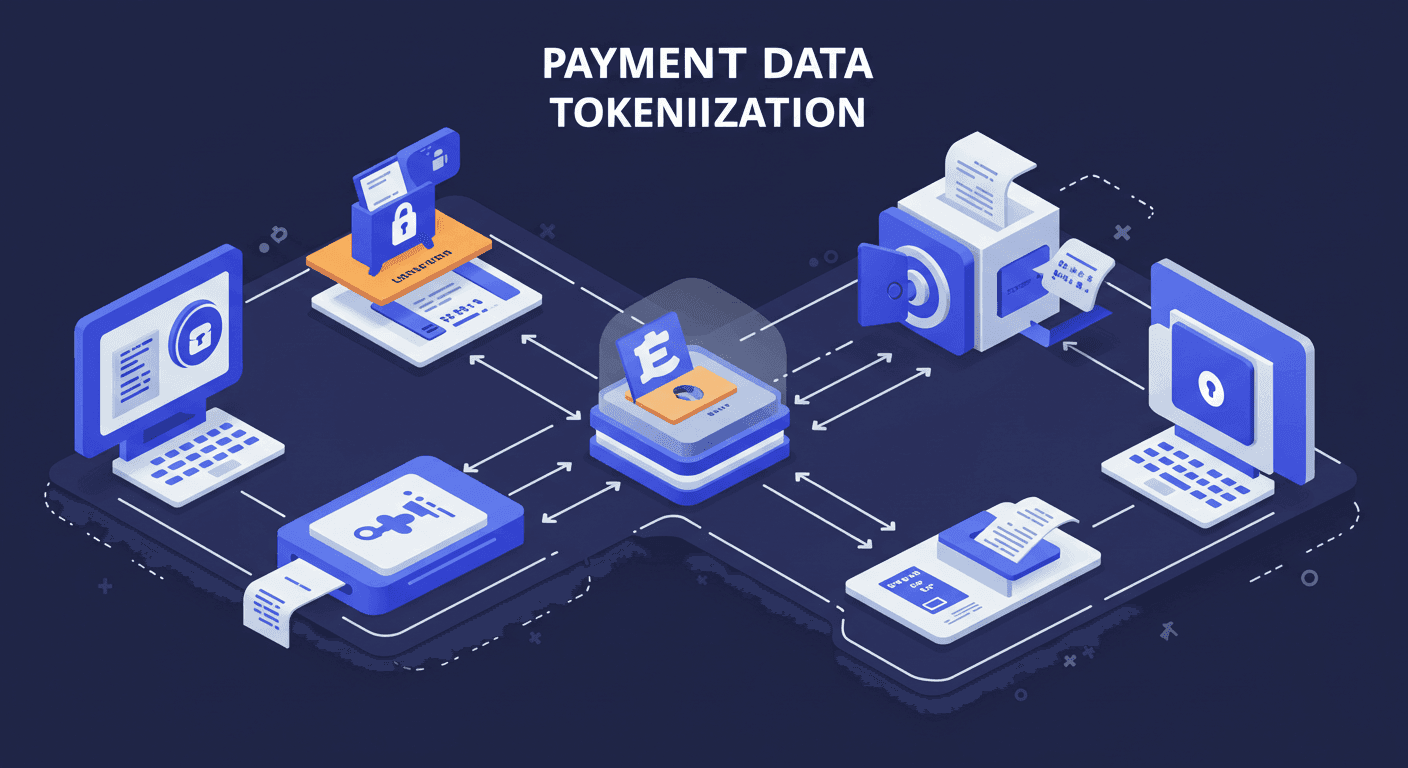

Payment processing is part of the financial system, businesses accept payments from customers. When you swipe your card, use mobile payments or transfer money online, payment processing systems handle the transactions.

These systems involve multiple intermediaries, payment gateways, acquirers, and processors to ensure funds flow smoothly from the buyer to the seller.

Key Laws in the US and EU:

New laws in both the US and the EU are affecting payment processing:

US Laws:

The Dodd-Frank Act and other recent regulations are providing more transparency and security in payment processing.

For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act introduced regulations to reduce risks associated with financial institutions, while GDPR (General Data Protection Regulation) is about consumer privacy and data security.

EU Laws:

PSD2 (Payment Services Directive 2) in the EU is introducing new requirements for payment providers, focusing on consumer protection, transparency and security in payments.

GDPR in the EU is about how businesses handle customer data and stricter controls over personal information.

Payment Providers:

Payment providers now have to comply with a more complex regulatory environment.

In the US, for example, compliance with the Dodd-Frank Act means payment companies have to provide more transparency in their operations so consumers and businesses have clearer information about fees and terms.

In the EU, PSD2 has forced payment providers to adopt stronger security measures. These include 2FA (two-factor authentication) and stricter monitoring of transactions to prevent fraud and data breaches.

Payment service providers will have to implement new technologies and processes to comply with these laws.

Also, payment providers will have to adhere to stricter privacy policies due to GDPR, so customer data is not only protected but also handled responsibly.

Businesses:

All businesses will need to adjust to the new regulations. For example under PSD2 businesses will have to offer better security features such as strong customer authentication.

This may mean integrating new technologies like biometric authentication or upgrading payment systems to comply with the law.

Small businesses will face challenges in adapting to these changes, especially when it comes to the costs of upgrading payment systems and training staff.

Larger businesses will need to dedicate more resources to compliance teams and cybersecurity to protect customer data.

For businesses the shift to more security and transparency will mean increased operational costs in the short term but long term benefits include stronger consumer trust and better fraud protection.

Consumers:

Consumers will benefit from the new laws especially in terms of privacy and security. GDPR in the EU gives consumers more control over their personal data, so companies can’t misuse or store their information without permission.

This means consumers will have the right to know how their data is being used and ask for it to be deleted if necessary.

PSD2 also brings better security for consumers and stronger authentication methods before processing payments. This makes it harder for fraudsters to access sensitive financial information, so consumers have more peace of mind when making online transactions.

Challenges and Opportunities:

While the new regulations bring many benefits, they also bring challenges. Payment processors will need to invest in new technologies to comply with the stricter security and privacy requirements.

Smaller companies will find it hard to meet these regulations, so there may be market shifts.

But the new laws also bring opportunities for innovation in the payment space. As businesses and payment providers adapt, we will see new technologies that make transactions even more secure and efficient. Companies that can get ahead of these changes will have a competitive advantage in a more regulated environment.

Conclusion:

The new laws in the US and EU will shape the payment processing landscape in the next few years. While they bring challenges they also bring opportunities for businesses, consumers and payment providers to improve security, transparency and trust.

As these regulations evolve businesses will need to stay informed and adapt their payment systems to comply and protect their customers.

FAQs:

What are the main changes in payment processing laws in the US?

The US has laws like Dodd-Frank and GDPR to improve transparency, security, and consumer privacy in payment processing.

How will PSD2 affect businesses?

PSD2 requires businesses to offer stronger security features like 2FA to protect consumers during transactions.

Will this affect small businesses?

Yes, small businesses will have to adapt to these new regulations, which may mean investing in new technology and security updates.