Ever wonder what happens to your card details when you pay online or tap your phone at the store?

With payment fraud on the rise, your personal and financial data can be at risk if it’s not protected properly.

This leaves many people worried about where their information ends up and how safe it really is.

That’s where payment data tokenization comes in — a simple method that replaces your card number with a fake code, helping to keep your data safe without changing how you shop.

What Is Payment Data Tokenization?

Payment data tokenization is a way to protect sensitive card information. It takes your actual card number and swaps it with a random string of numbers called a token. This token doesn’t mean anything on its own.

But when it's sent through the payment system, it links back to your real data, safely stored somewhere else.

Think of it as using a movie ticket instead of handing over your bank card. The ticket lets you enter the cinema, but if someone else finds that ticket later, it’s useless. It only works for that show, at that time, and for that person.

Tokenization is not the same as encryption. With encryption, the data is scrambled and can be unscrambled with a key.

Tokens don’t follow a pattern and cannot be reversed. Even if someone tries to break into the system, all they get are meaningless numbers.

Why Is Tokenization Used in Payments?

The main reason tokenization is used is to protect payment data from being stolen. Credit card fraud is a growing issue worldwide. According to Statista, global payment fraud losses hit $34.6 billion in 2023, and they're expected to rise.

Tokenization helps lower this risk. When businesses use it, they don’t have to store card details. That means there’s less for hackers to steal. Even if a system is breached, the stolen tokens are useless outside of that system.

Tokenization also helps companies follow rules like PCI DSS (Payment Card Industry Data Security Standard). These are rules businesses must follow to keep customer data safe. By using tokenization, companies meet these rules more easily and avoid fines.

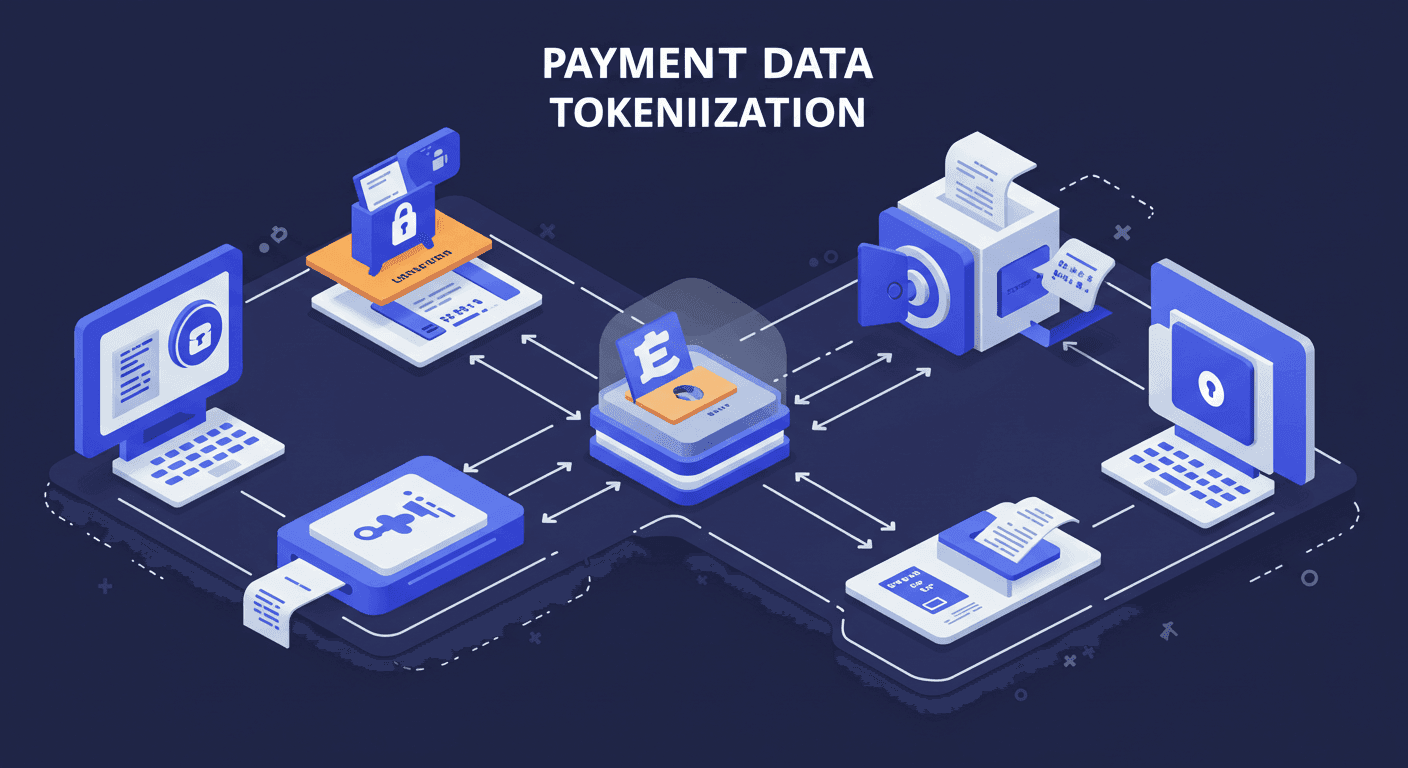

How Payment Data Tokenization Works Step by Step

Let’s look at what happens when you pay online or with your phone:

Step 1: You enter your card number at checkout.

Step 2: The payment processor creates a random token to replace your card number.

Step 3: This token is sent to complete the payment. Your real card number is stored securely in a token vault—a special, protected server.

Step 4: The business only sees the token. It can’t turn the token back into your real card number.

If someone tries to steal the token, they can't use it anywhere else. It only works in that one system for that one business.

Types of Tokenization Methods

There are a few different ways tokenization works, depending on the system:

1. Gateway Tokenization

This happens through the payment gateway. When a customer pays, the gateway replaces the card number with a token before passing the data forward.

2. Vault Tokenization

Here, a secure database (called a vault) stores the real card data. The system gives out a token instead, which points to the data in the vault.

3. Format-Preserving Tokenization

This method keeps the token looking like the original data—for example, the same number of digits as a credit card. Some businesses use this to avoid changing how their system stores data.

Where Is Payment Tokenization Used?

You’ve probably already used tokenization without realizing it. It’s used in:

-

Online shopping: Many e-commerce sites use tokens so they don’t store your card data.

-

Mobile wallets: Services like Apple Pay and Google Pay use tokenization to replace your card number.

-

In-store payments: Tap-and-go cards and card readers at shops often use tokenized data.

-

Recurring payments: Subscriptions and apps keep your token, not your real card number.

This helps businesses offer smoother checkouts without holding your sensitive details.

Tokenization vs. Encryption: What’s the Difference?

Both encryption and tokenization are used to protect payment data, but they work differently.

-

Encryption scrambles data into unreadable text using a key. If someone has the key, they can unlock the data.

-

Tokenization replaces data with a token that has no link to the real data unless it goes through a secured system.

Encryption is often used when data must travel across a network. Tokenization works better when the goal is to avoid storing sensitive data altogether.

In many systems, both are used together for extra security.

Is Tokenization Safe?

Yes. Tokenization is considered very safe. Since the token doesn't contain actual data, there's nothing useful to steal. Even if a hacker gets access to a token, they can't use it in other systems.

According to Visa, merchants who use tokenization see a 26% drop in fraud rates. Also, the token cannot be reused outside the original system, making it safer for recurring payments.

Some systems even tie tokens to specific devices or customers, making them even harder to misuse.

Challenges or Limitations of Tokenization

Tokenization is helpful but not perfect. Here are a few limitations:

-

Setup cost: Small businesses might find it expensive to set up tokenization, especially if they need new hardware or software.

-

System compatibility: Older payment systems may not support tokenization without upgrades.

-

Dependence on token vaults: If the vault fails or gets compromised, it could disrupt the service.

Despite these issues, the benefits of tokenization usually outweigh the drawbacks.

The Future of Tokenization in Payments

As digital payments grow, tokenization is expected to become even more common. It helps keep payments secure without changing how users pay.

With mobile wallets, wearables, and IoT payments on the rise, businesses need better tools to protect data. Tokenization fits right into this future by offering simple, safe, and flexible protection.

Even industries outside finance—like healthcare and travel—are now exploring how tokenization can protect sensitive information.

Final Thoughts

Understanding how payment data tokenization works helps both customers and businesses stay safe. It swaps your real card number with a fake one that only the payment system understands.

This extra layer of security reduces fraud, makes compliance easier, and keeps your sensitive information away from prying eyes. With digital payments increasing every year, tokenization is one of the best tools we have to protect how we pay.

FAQs

Does tokenization affect how fast a payment goes through?

No. Tokenization happens instantly in the background. It doesn't slow down the payment process.

Can a token be reused?

Tokens can sometimes be reused within the same system for recurring payments, but they’re useless outside that system.

Do all businesses use tokenization?

No. While many large businesses use it, some smaller ones might not have it in place yet.