What happens when a fintech company skips a step in verifying its users?

Financial fraud rises, user accounts get misused, and trust breaks down fast. That’s the risk many fintech companies face when they overlook KYC (Know Your Customer) and AML (Anti-Money Laundering) practices.

These aren't just boring rules- they’re safeguards that protect both the business and the people who use it.

When a fintech skips KYC or treats AML lightly, it becomes easy for bad actors to move illegal money or trick people. This leads to legal trouble and lost users.

The good news? Setting up simple KYC and AML steps early can protect your company, help you grow, and earn customer trust. Let’s explore why these steps matter so much in fintech.

What Is KYC? And Why Do Fintechs Need It?

KYC stands for "Know Your Customer." It means Fintech companies must check who their users are before letting them use the service. This helps stop fraud and keeps the platform safe.

KYC is done by asking for personal documents like ID cards, photos, or proof of address. It makes sure users are real and not pretending to be someone else.

Without this check, criminals can easily open fake accounts to scam others or move stolen money.

So, KYC is not just a rule - it’s a safety shield that protects both the business and the user.

What Is AML, and How Does It Work in Fintech?

AML means "Anti-Money Laundering." It’s a set of rules and systems that help stop the use of fintech platforms to clean dirty money.

Money laundering is when someone makes illegal money look legal. They might use apps or wallets to move it around so no one finds out.

AML helps spot these patterns. It flags strange activity, like big transfers or weird login locations, so the company can look into it.

Fintech firms use tools that track and report such signs to the authorities if needed.

Why KYC and AML Matter for Fintech Companies

Fintech firms deal with real money and real users. If criminals get through, the damage can be huge - money lost, users leaving, or government fines.

KYC stops fake users from coming in. AML catches bad activity once someone’s inside. Together, they make fintech platforms strong and trusted.

When these tools are missing, fintech apps become playgrounds for fraud and scams.

This is why regulators all over the world demand these steps.

Real-World Examples of KYC/AML Failures in Fintech

In 2020, a big fintech company was fined over $60 million in the U.S. for not following AML rules. They allowed users to open accounts without clear checks.

Another popular payment app got flagged when people used it to move stolen money. The app didn’t catch the signs early.

These aren’t rare cases. Even strong platforms fall when they take KYC and AML lightly.

Fines, lawsuits, and loss of trust follow quickly.

How KYC and AML Help Build Customer Trust

When users sign up for a fintech app, they want to feel safe. If they hear about fraud or stolen funds, they leave fast.

KYC and AML show users that a company is serious about safety. It’s like having security cameras in a store - people feel better when they see them.

This builds long-term trust. Users are more likely to stay, refer friends, and use more services.

Trust is slow to build but quick to lose - KYC and AML help keep it strong.

Are There Fines for Non-Compliance? Yes, Big Ones

Not following KYC or AML rules can lead to huge fines. In 2022 alone, global financial institutions paid over $4 billion in penalties for weak controls.

Even small companies are not safe. Regulators now check startups and apps more closely.

Ignoring the rules to grow faster can backfire. It may lead to legal trouble, bad headlines, and even getting shut down.

Doing things right from the start is much safer.

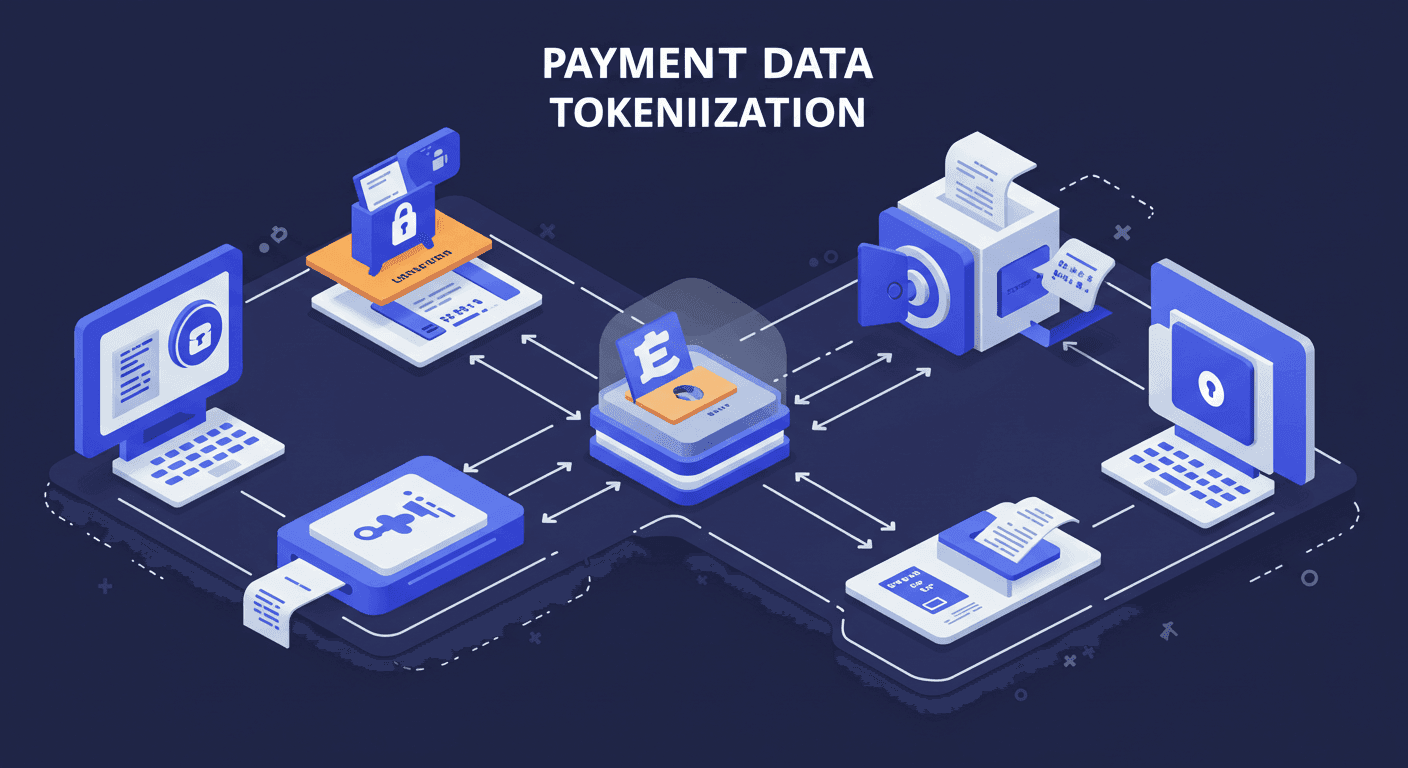

The Role of Technology in KYC and AML for Fintech

Thanks to new tools, KYC and AML aren’t as hard as they used to be.

There are apps that scan ID cards, use facial recognition, and track suspicious behavior using smart software. These tools run in the background without slowing things down.

Fintechs can also use APIs to plug these features into their platforms.

It saves time, reduces errors, and gives a clear audit trail when needed.

Is KYC Only for Big FinTechs? No, Even Startups Need It

Some small fintech founders think KYC and AML are only for banks or big apps. That’s not true.

Regulators now expect even small firms to follow basic rules.

Even if you’re just launching, doing KYC can prevent early misuse. It also makes it easier to raise money later - investors look for strong safety practices.

Skipping it now might cost more later.

Challenges Fintech Companies Face with KYC and AML

There are real challenges. Some users don’t want to share personal data. Others may drop off during sign-up if it feels too hard.

Also, rules change from one country to another. A fintech working in many regions has to keep track of all of them.

Sometimes, fake IDs get past checks. That’s why updates and audits are important.

Despite these hurdles, the benefits of doing it right are much bigger.

How Fintechs Can Stay Compliant and Avoid Trouble

Start with clear KYC steps like ID checks, photo verification, and document uploads. Make the process quick but strong.

Use AML tools that track transfers, location mismatches, and red flags. Set alerts and review them regularly.

Train your team to spot unusual activity. Keep logs and records to show you followed the rules.

Working with legal and compliance experts also helps stay on track.

Final Thoughts: A Small Step That Makes a Big Difference

KYC and AML might seem like just extra steps during signup, but they matter more than most realize.

They protect users, prevent misuse, and keep the company out of trouble. Fintechs that care about trust and growth can’t afford to ignore them.

Even small efforts go a long way when it comes to security and staying in business.

Doing it right from the start saves time, money, and reputation later on.

FAQs

What documents are required for KYC in fintech apps?

Most fintech apps ask for a government-issued ID, a selfie, and proof of address like a utility bill or bank statement.

How long does KYC verification take in fintech?

It usually takes a few minutes to a few hours, depending on the platform and the number of users signing up at once.

Are KYC and AML required in all countries?

Yes, most countries require fintech firms to follow KYC and AML rules, though the exact laws may differ.